Selling Used Gear Online? Survive A Sales Tax Audit!

Sales tax may feel like an overwhelming part of your business. Understanding and managing it is a crucial part of keeping your operations smooth and compliant. Let’s break it down, so you can focus on what you do best, making those sales and growing your business!

What is Sales Tax Nexus?

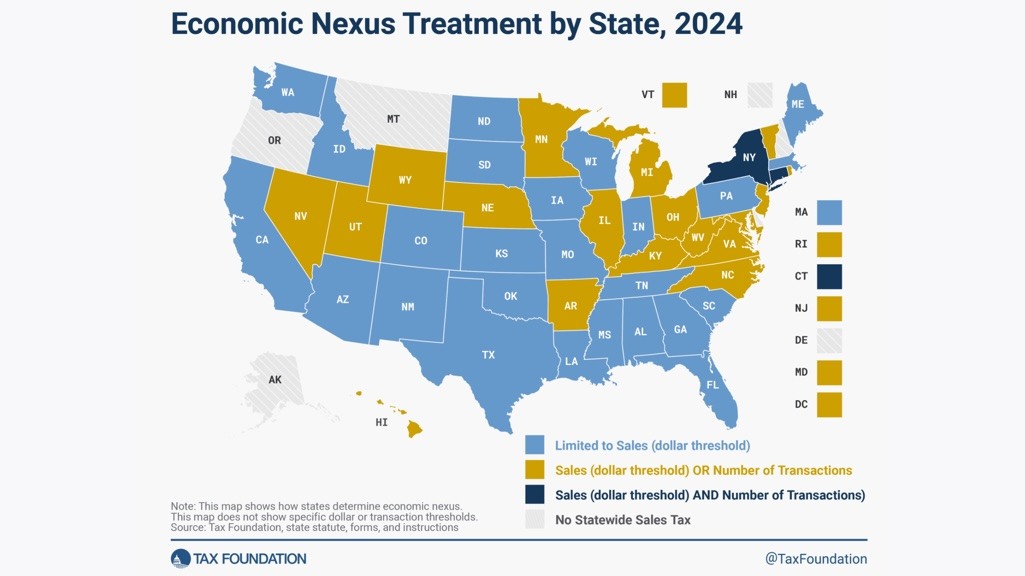

Sales tax nexus is the connection that makes you a tax collector in a state. It can happen in two ways:

- Physical Nexus: Got a store, warehouse, or employees in a state? Congrats, you’re now officially on the hook for collecting sales tax there.

- Economic Nexus: No physical presence? No problem (for the state, that is). If you’re making sales in a state, you might still need to collect sales tax. The rules are complicated and they vary, so keep an eye on changes that may impact your business!

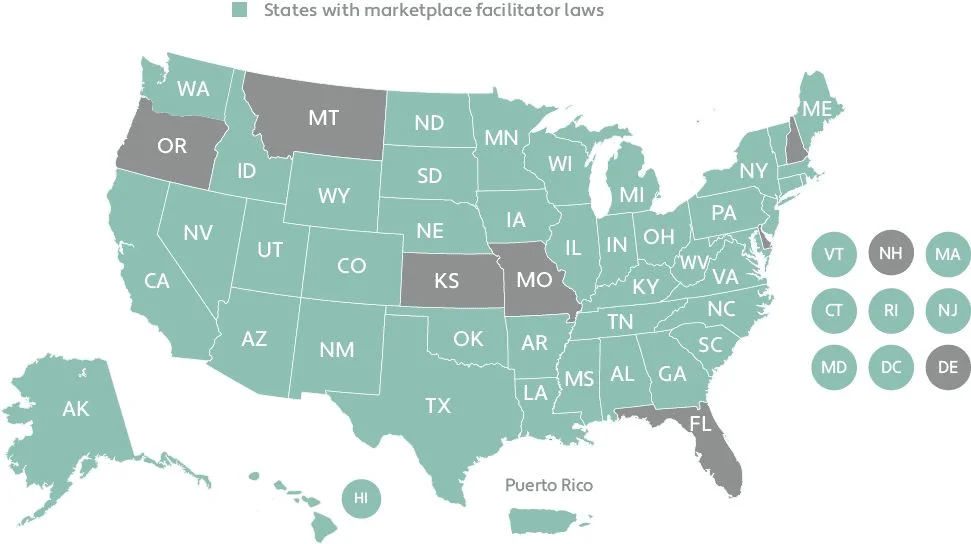

Marketplace Facilitator Laws

To supposedly “simplify” compliance, many states have introduced marketplace facilitator laws. These laws require platforms such as GearSource, Amazon, eBay, and Etsy to collect and remit sales tax on behalf of their sellers. Needless to say, if you’re selling with GearSource, consider us your reliable tax partner! We’ll take care of calculating, collecting, and remitting taxes to the appropriate authorities, so you don’t have to worry about it. However, if you also sell directly through your website or social platforms like Facebook Marketplace, you will need to manage taxes for those sales yourself. Knowing the rules ensures you don’t overlook any obligations and subject your business to extremely costly penalties and disruptive audits.

Different States, Different Rules

Each state has implemented micro-rules, within the overall code and of course, this adds additional confusion and complication. Some of these state based differences include:

- Tax Rates: Sales tax rates vary, and some cities or counties add in additional taxes. Ensuring you’re charging the right amount and don’t accidentally shortchange the taxman is quite important.

- What is Taxed: Some states give a free pass on categories including groceries; others, do not. Clear as mud, right? Know what’s taxable where you’re selling, or you might get an unexpected bill.

- Filing Taxes: States have different schedules for when they want their money - monthly, quarterly, or yearly. Missing a deadline can lead to penalties.

Stay Compliant

Sales tax compliance is about more than just collecting and remitting taxes. You are required to keep detailed records, file returns on time, and stay current with the ever changing landscape of tax regulations. Mess it up, and you could face significant fines. Keep it straight, and your business will stay in good standing!

Get Help

Sales tax can be more complicated than it looks, but you don’t have to go it alone:

- Software: There are tools that calculate sales tax and help you file returns

- Tax Professionals: If the whole thing feels like trying to do calculus, a tax professional can make sure you’re doing everything right.

Stay Compliant!

Understanding domestic sales tax rules is essential for any online seller. By knowing your nexus status, understanding state specific rules, and staying on top of deadlines, you can avoid costly mistakes. Whether you use software or consult with a professional, make sure you’re prepared to handle sales tax confidently.

- Don’t Ignore Nexus: Even if you don’t have a physical presence, you might still need to collect sales tax if you meet economic nexus thresholds in a state

- Charge the Right Rate: Ensure you’re using the correct tax rate for each location, or you might find yourself footing the bill.

- File on Time: Set reminders so you don’t miss tax deadlines. Penalties are about as fun as spilling coffee on your laptop.

- Consider selling through a knowledgeable marketplace like GearSource, who will manage the process for you, and ensure your buyers are only taxed when absolutely necessary, and that you are compliant and free and clear from sales tax liability.

Author - Amanda Hart - Finance Coordinator