Marketplace Facilitator Sales Tax Law… You NEED TO KNOW!

First, what is a Marketplace Facilitator?

GearSource, Reverb, Etsy, eBay, Amazon are all Marketplace Facilitators!!

A Marketplace is any online business that provides a platform for sellers to sell their goods and buyers to buy those goods. The Facilitator (that’s us) enables the resale of goods by providing the online marketplace sellers to list products, place orders, handle payments, provide customer service and accept or assist with shipping and returns.

Now, what is the Marketplace Facilitator tax law?

Marketplace facilitator tax laws grew from the idea that a state could collect all of the required sales tax from one entity rather than from thousands of smaller companies. This law came about as a result of a lawsuit filed by the state of Delaware against online marketplace, Wayfair.

Before these tax laws came into effect, each of the Sellers on GearSource.com, for example, was responsible for calculating, collecting and remitting their own sales tax. If the seller on GearSource didn’t have nexus* then it didn’t have to collect sales tax for sales in that state. And the state then missed that portion of revenue.

By placing the onus of sales tax on the Marketplace facilitator (GearSource) rather than the seller, these laws enable the states to force compliance across the entire state, and dramatically reduce the cost of compliance for states to claim their revenue.

Simply, it is a way for the tax man to collect taxes on sales that were previously not being taxed.

What does this mean for sellers?

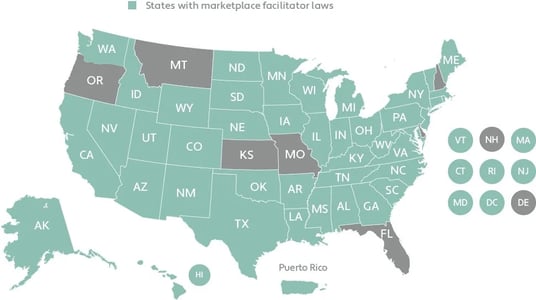

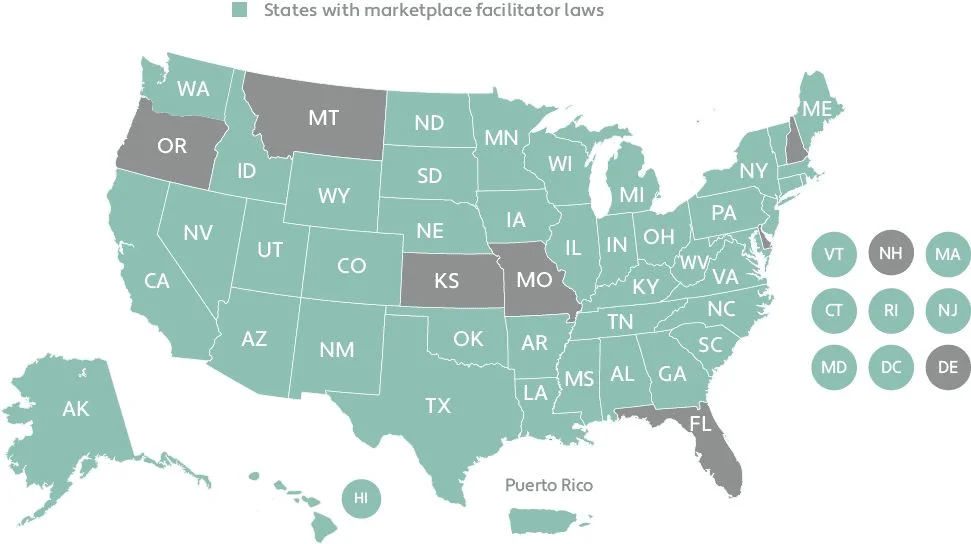

Most US states have now enacted the Marketplace facilitator law, which requires online marketplaces, such as GearSource, to collect and remit sales tax on behalf of the sellers.

This isn’t optional on our part… as long as one of the following apply, GearSource has to comply:

- The Marketplace Facilitator (remember, that’s us) has a physical presence in the state where the goods are shipping to (in our case, Florida)

- The marketplace Seller has a physical presence in the state

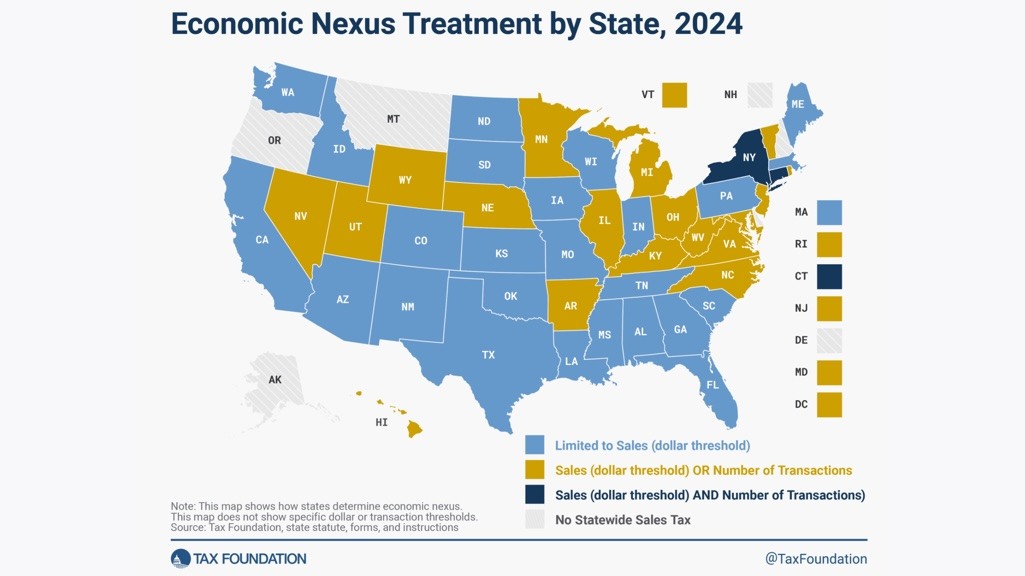

- The collective annual sales into the state surpass the threshold of that state – the common threshold is $100,000 in annual sales OR 200 separate transactions.

The upside for sellers is that GearSource will now handle calculating, collecting and remitting sales taxes on behalf of your sales in all the states where we are compliant.

Should Sellers keep sales tax permits current?

The general consensus is yes. Remember, GearSource (or any marketplace) is only going to handle the sales tax on transactions sold through GearSource.com.

So, if GearSource is collecting sales tax on your behalf in Washington, but you are located in Washington and you sell items through your business website too, you still need to collect, remit, and file in the state for the sales on your website. To do that, you have to have a current license or permit. And in most states, if you don’t do any sales outside of those with the facilitator, you’re required to file a simple “zero return” saying so, or register for non-reporting sales tax status.

Bottom line… it’s imperative that you as the Seller arm yourself with all of the relevant information about possible marketplace facilitator laws. Below we’ll share all of the information that we know on which states currently impose these laws and the facts you need to know to stay up-to-date.

What does this mean for our buyers?

All buyers are technically subject to the tax if GearSource or the seller meet thresholds in the state the item is being shipped to. Any buyer who qualifies as tax-exempt, or the item being purchased is tax-exempt in your state, will need to submit a resale-certificate to GearSource prior to making a purchase, otherwise the transaction is subject to sales tax.

At the end of the day, GearSource has a legal responsibility to ensure taxes are collected (or not collected) correctly. As Benjamin Franklin once said… “there are only two things certain in life: death and taxes.”

*Nexus is a concept developed by the various states in the U.S. to determine whether a taxpayer is a taxpayer. In short, nexus is a closeness or connection between the taxing jurisdiction and the person that the jurisdiction is seeking to impose its tax obligations upon.