Understanding Tariffs on Used Gear: What GearSource Sellers and Buyers Need to Know

With the ongoing trade tensions and potential tariff changes, we’ve been hearing a lot of concern from our GearSource customers—especially about how these tariffs could impact the sale and purchase of used gear across borders. One of the biggest misconceptions we see is the belief that tariffs are based on the country a product is shipping from. The reality? Tariffs are determined by the country of origin of the product, not the location it’s being shipped from.

At GearSource, we’re constantly monitoring changes that could affect our sellers and buyers, and we want to ensure you have the right information to make informed decisions. Let’s break it down.

How Do Tariffs on Used Gear Actually Work?

1. Country of Origin, Not Shipping Location

When customs officials assess duties or tariffs on imported goods, they don’t just look at where the item is being shipped from—they look at where it was originally manufactured.

- If a moving light was originally made in China but is now being sold from a warehouse in Canada, U.S. customs will still consider it a Chinese-made product and apply any applicable tariffs based on China’s trade status with the U.S - not Canada’s (should a tariff be added for Canada).

- If a digital console was originally manufactured in the U.K. but is being resold from a U.S. location to Canada or Mexico, no additional tariffs would apply (unless a tariff is put in place by either Canada or Mexico).

This is where many businesses make costly mistakes—assuming that shipping from a non-tariffed country eliminates tariff liability. It doesn’t when the gear is manufactured in a tariffed country.

2. Tariffs Apply to New and Used Gear Alike

Another common misunderstanding is that tariffs only apply to brand-new products. In most cases, tariffs apply to used equipment just as they do to new gear. If an LED wall was originally manufactured in a tariffed country such as China, its used status doesn’t exempt it.

However, there are occasional policy shifts where exemptions apply, and we always advise our customers to check with their customs brokers or reach out to our team for guidance.

What This Means for GearSource Customers

For Sellers:

- Be transparent about the original country of manufacture. If you’re listing items for sale internationally, clearly identify where they were originally made, not just where they are currently located. This will help buyers anticipate any tariffs.

- Consider demand shifts. Tariff concerns may lead some buyers to favor gear manufactured in countries unaffected by new tariffs. If you’re selling, positioning your products accordingly could make a difference.

For Buyers:

- Plan for tariffs in your budget. If you’re importing gear from another country, research the original manufacturing country to understand any potential duty fees.

- Ask questions before purchasing. If a seller hasn’t listed the country of origin, don’t assume—it’s always best to confirm before finalizing a deal.

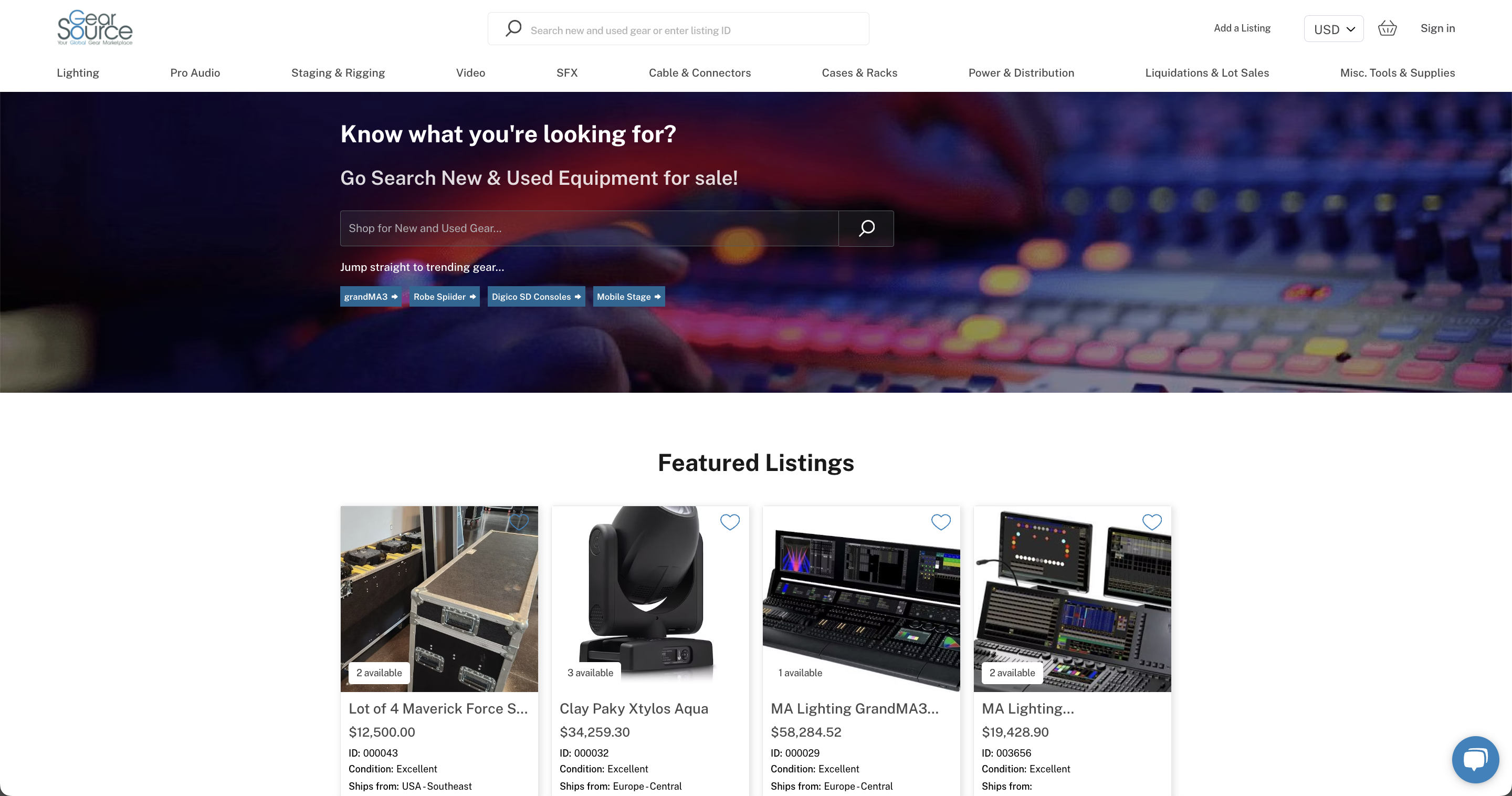

GearSource: Your Trusted Partner in Global Gear Sales

At GearSource, we’re not just a marketplace—we’re a team of industry experts committed to helping our customers navigate challenges like these. We work with global buyers and sellers ensuring smooth transactions and keeping everyone informed about critical trade policies.

If you have questions about tariffs, international shipping, or how these changes could affect your business, we’re here to help. Reach out to us anytime for guidance.

Stay Informed, Stay Confident

Trade policies and tariffs can feel overwhelming, but knowledge is power. By understanding the true factors behind tariff costs, GearSource customers can continue doing business smoothly and efficiently. No matter what changes come, we’ll be here to provide expert insights and support.

For further updates on tariffs and trade regulations, keep an eye on our blog or reach out to our team.

Marcel Fairbairn / Founder & CEO